Embedded Lending

SciFi Theses

This post is the first in a series of SciFi Theses. In this series, we will share ideas for companies that we at SciFi think should be built. If you are building an Embedded Lender, or are interested in starting one with us, please reach out to fintech@scifi.vc.

Brands are increasingly offering financial products to their customers, leveraging their $0 marginal distribution cost to compete against financial services providers with multi-year CAC payback periods. At SciFi, we believe that lending is the biggest opportunity in embedded finance, and that several successful Embedded Lenders will emerge in the next few years. Embedded Lending is particularly interesting because:

Brands can drive revenue by distributing loans with close to zero marginal CAC;

Borrowers are already accustomed to borrowing from multiple lenders other than their principal banking provider;

Loans can be offered when users have significant need and/or high intent;

Brands have access to highly predictive proprietary data signals for underwriting and pricing; and

Lending can reinforce core engagement and retention loops by driving purchases and brand loyalty.

The successful Embedded Lenders of the next decade will provide full-stack, white label lending operations to their brand partners. Embedded Lenders will provide software infrastructure for KYC, underwriting, and servicing; employ human operators to manage risk and service loans; and build partnerships with debt providers and banks. In essence, the Embedded Lenders will do everything except for distribution. This will enable every brand to spin up lending programs quickly and cheaply. In this post, I’ll highlight why brands should not lend themselves and why the opportunity for standalone Embedded Lenders is exciting.

Why work with an Embedded Lender?

The answer is simple. Lending is the ultimate economy of scale business with high startup costs, initially negative unit economics, and massive scale requirements to reach profitability.

At minimum, it takes 10 people a full year to launch a new lending product. The team needs to build or buy core systems like the ledger, integrate multiple third party data sources, develop and backtest underwriting models, acquire the necessary licenses to lend legally, and raise debt to fund loans.

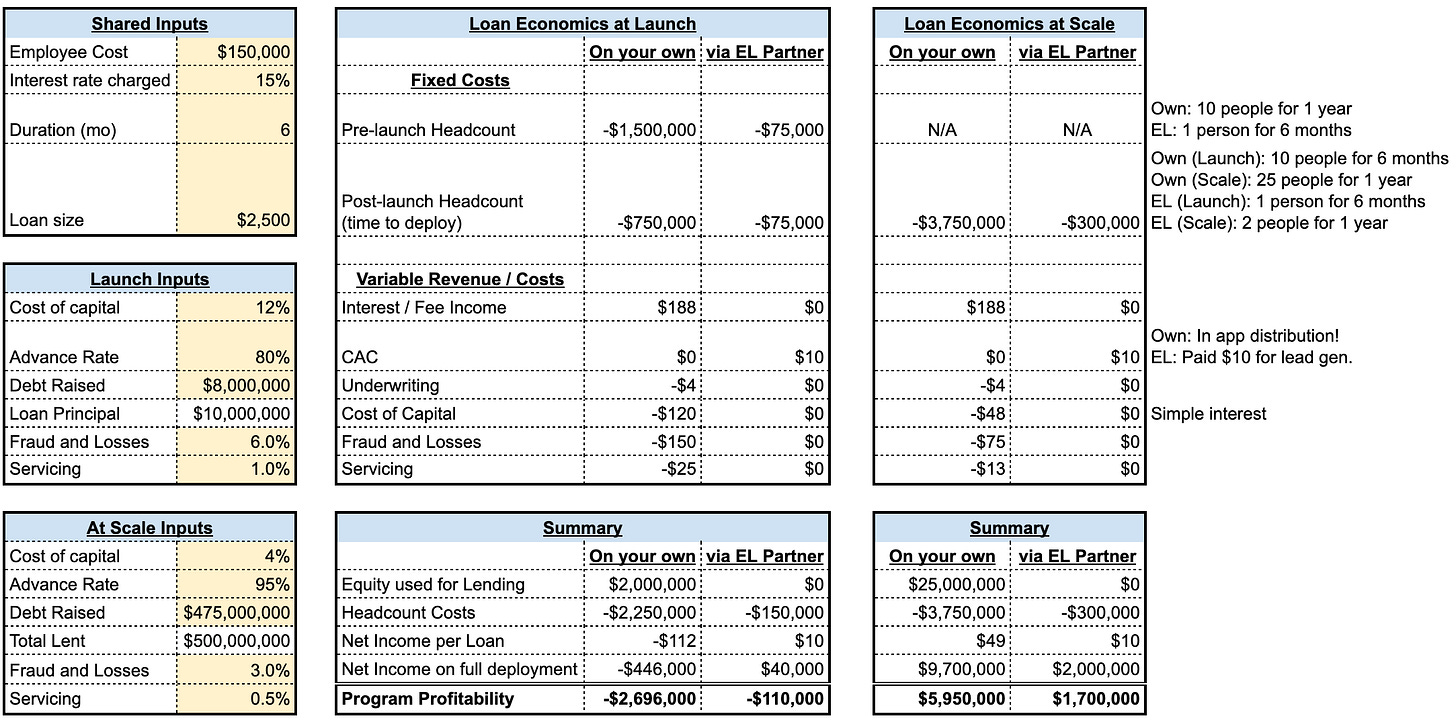

Raising debt capital is expensive, and the table below highlights how expensive launch costs drive negative contribution margins at launch for a $2500 personal loan. I roughly estimate that new lenders can lose ~$3 million from their initial $10 million of loans, split between setup costs and upside down unit economics. Becoming profitable is a herculean task that requires slashing unit costs like fraud and losses, while also scaling up to 9 figures of loan originations per year.

On top of this, brands lending directly risk tarnishing their margins. Capital used to fund loans comes directly out of Free Cash Flow, preventing investment in other parts of the business. A successful loan program will demand even more equity investment. At scale, brands face investors valuing the business on lending volume, which represents significant multiple compression for a marketplace or software business.

Contrast this to working with a white label Embedded Lender, and the choice is clear. Because the Embedded Lender splits the infrastructure costs across multiple brand partners and drives down unit costs with scale, the Embedded Lender can be profitable even when a brand could not be.

Brand partners should work with Embedded Lenders because the loan economics are more favorable this way both at launch and at scale. While the above numbers are illustrative, brands must invest several million dollars to launch a loan program that they cannot expect to recoup.

Embedded Lender Strategy

It is worth asking why it is attractive for the Embedded Lender to get into this business themselves. In short, the Embedded Lenders will be able to reach the critical scale necessary to operate a profitable lending program by aggregating demand from balance sheet-light brand partners. Let’s analyze this strategy more deeply by considering the four critical components of any lending company: distribution, underwriting, capital markets, and core operations.

Distribution

As mentioned above, distribution is the one thing that the brand is responsible for doing themselves. The Embedded Lender’s role in distribution is to provide tooling that minimizes the effort for a brand to launch a program. This will include online systems for uploading and managing brand images and content, email marketing tools for broadcasting to a brand’s existing user base, web and mobile app plugins for advertising the loan, and white label digital application flows. Candidly, these tools are not revolutionary and the Embedded Lender could even buy some of them from other vendors like Blend, Peach Finance, and Sentilink. However, offering them together as a package reduces the time to integrate with an Embedded Lender by several months.

Underwriting

The Embedded Lender’s biggest underwriting advantage is the ability to extract signals that are highly predictive of loan performance from proprietary data furnished by brand partners. Ideally, brand partners would share data on all of their customers so that the Embedder Lender has a wholistic understanding of what best-in-class customers look like and can make targeted loan offers. This proprietary data will augment a foundational model using traditional underwriting signals. A key hypothesis here is that Embedded Lenders will be able to normalize proprietary signals across multiple brands offering the same loan product. For gig economy drivers, this could mean directly comparing income, reviews, time on platform, and earning potential across Uber, Doordash, Instacart, and other platforms. An obvious benefit of normalization is increasing the size of the risk model’s training data set. A less obvious benefit is that if normalized well, these models would work for newly onboarded brand partners out of the box, potentially short-circuiting years of work needed to extract value from these signals.

Embedded Lenders will use traditional credit signals and proprietary data from brand partners when underwriting. Proprietary data must be normalized so that data from similar brand partners are directly comparable.

The “Holy Grail” for the Embedded Lender is to see the same borrower across multiple brand partners, giving the lender a viewpoint on borrowers that no other company could possibly build. For new borrowers, this means that the Embedded Lender will be able to accurately underwrite multiple income streams for individuals and businesses that may not have qualified using just one. When an Embedded Lender is integrated with multiple brand partners in the same category, the incidence of repeat borrowing will increase since the first time borrowing through a brand partner may be the second time borrowing from the Embedded Lender. This is a major profitability advantage because repeat borrowers have substantially lower default risk than first time borrowers, enabling the Embedded Lender to out-price any competitors using both proprietary partner data and proprietary repayment data.

Aggregating data across brand partners comes with its own challenges. Companies are generally reluctant to share data with competitors and are increasingly concerned with data privacy. The Embedded Lender will need to overcome these challenges with a combination of business and technical solutions. On the business side, the Embedded Lender must make a compelling data-driven case that they are able to underwrite more of each brand’s customers by aggregating data from all brands. This is a positive-sum game, and will become increasingly important as platform fragmentation increases. On the technical side, the Embedded Lender must address both data access and data privacy. Data access solutions like Ethyca can prevent brand partners from accessing data provided by other brand partners. Data privacy solutions like VGS can be used to obscure sensitive data that will be passed through to another party, and techniques like synthetic data generation or differential privacy can be used analyze non-borrower data without direct access to those records.

Taken together, more predictive signals allow the lender to decrease price without harming contribution margin, which drives more loans. By aggregating proprietary data from multiple brand partners, the Embedded Lender creates a more nuanced understanding of the borrower than could be built via a single direct relationship. This is a virtuous cycle that compounds with the capital markets advantages described below, making it difficult for new lenders to compete without significantly negative initial margins.

Capital Markets

Raising capital to fund loans is a critical component of any loan program. Unfortunately, new lenders are at a massive disadvantage relative to depository institutions that use plentiful deposits earning <<1% APY to fund loans. In contrast, new lenders often pay 15% or more on their initial debt facilities and, assuming they offer competitive rates to borrowers, almost certainly have negative contribution margins on day one.

The Embedded Lender’s role is to fully isolate the brand partner from the challenges of the capital markets such as capital disruptions and covenant breaches. Brands should not need to work with debt providers, provide equity capital to fund a portion of loans, or face significant penalties should the debt covenants be breached. To reiterate, brands should just focus on distribution.

The Embedded Lender itself has the opportunity to significantly reduce its cost of capital by adding additional brands to existing loan programs. If the Embedded Lender is able to prove that similar brands drive loans with similar returns, cost of capital will decrease substantially over time even as the loan program expands to accommodate new brands. At scale, we’d expect the Embedded Lender to borrow at 4-7%.

Over time, the Embedded Lender must start to consider off balance sheet financing solutions to decrease hefty equity participation requirements and to avoid valuation multiple compression from investors. Lenders can generally access whole loan sales and securitization after reaching $500M-$1B+ of annual originations. These are particularly attractive to lenders because they front-load revenue from each loan cohort. One caveat is that loan buyers will expect the Embedded Lender to show that they have “skin in the game” by continuing to fund a small portfolio of loans, and how that portfolio is constructed is heavily negotiated. The Embedded Lender must also mitigate the risk of capital disruptions by working with multiple capital sources. This is an operationally complex challenge since each source has minimum capital deployment requirements, may have different underwriting and reporting criteria, and must be ready to support the full book of business should other sources turn off. Despite the difficulty of moving loans off balance sheet, it is the clear choice to improve cashflow and is only accessible to Embedded Lenders that achieve high scale through aggregation.

Core Operations

Embedded Lenders have the benefit of building and scaling core systems and processes once. Broadly speaking, this can be split into technical infrastructure, lending operations, and regulatory compliance. The cost benefit of building one tech stack shared amongst many branded loan programs is obvious since it is a fixed cost. Lending operations refers to the variable headcount needed for KYC, loan servicing, and other activities. Embedded Lenders have an advantage over brands here because their increased scale allows them to invest in technology which improves the efficiency of loan ops employees. Doubling the number of loans per customer support agent can lead to double digit percent increase in loan profitability. Regulatory compliance refers to acquiring the requisite state and national licenses for lending, or partnering with financial institutions that have those licenses. Complying with regulations and making appropriate partnerships is nearly identical across brands and fairly similar even across loan types. It will be important for the Embedded Lender to shield the brand from repercussions of non-compliance.

Example Embedded Lenders

Given the size of the market and complexities of underwriting and capital markets in particular, we believe that several Embedded Lenders will become successful in the next decade. These will include:

Personal loans for labor marketplaces. There is an opportunity to underwrite these workers using historical income and ratings data, and to sit in the flow of funds for collections.

Payroll advances. Employees often wait two weeks to receive earned wages. Every payroll company could offer something like Gusto Cashout to give immediate access to earned wages.

Small business working capital. Lending to small businesses is notoriously difficult because underwriting requires accurate cash flow analysis. A white label version of Square Capital or Quickbooks Capital for other SMB vendors could use real time access to bank accounts to underwrite and collect. There is an additional opportunity to build this specifically for ecommerce businesses.

Collateralized lending. Online investment advisors already have a strong financial relationship with consumers. Loans collateralized with investment assets could give borrowers access to lower interest rates than available in unsecured loans, or allow them to access capital without incurring a taxable event.

Summary

There is a massive opportunity for brands across technology and finance to distribute loans to their customers. By offering lending products, brands have the opportunity to increase their revenue while also driving engagement, retention, and loyalty. Despite having no or limited incremental distribution cost in cross-selling these loans, extremely high fixed costs and small scale make it nearly impossible for a brand to profitably launch a lending program internally.

Embedded lending startups will solve this challenge by providing fully white label lending programs to brands that have distribution. Brands will only need to provide distribution and data, and will receive a 100% gross margin lead generation fee for this service. By amortizing fixed infrastructure across multiple brand partners, aggregating data to build better credit models, and leveraging scale to decrease cost of capital, Embedded Lenders will build massive and profitable programs where brands cannot.

If you are building an Embedded Lender or are interested in starting one, we would love to talk to you. Please reach out to fintech@scifi.vc.